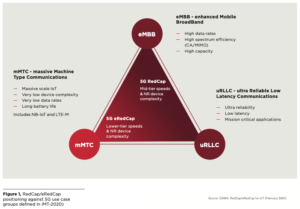

5G Reduced Capability (RedCap), introduced in 3GPP Release 17 and refined in Release 18 with enhanced RedCap (eRedCap), marks a pivotal step in the evolution of 5G for mid-tier applications. Positioned between the extremes of massive machine-type communications (mMTC) and enhanced mobile broadband (eMBB), RedCap addresses a previously underserved segment – namely, devices requiring modest data throughput, reduced latency and extended battery life, but without the cost and complexity of full 5G NR.

Originally referred to as “NR-Light,” Release 17 RedCap simplifies the 5G device transceiver by limiting bandwidth (up to 20 MHz), removing support for carrier aggregation and dual connectivity, and supporting single-antenna configurations. These design choices significantly reduce device complexity, size and power consumption while maintaining a peak data rate of up to 226 Mbps in downlink and up to 120 Mbps in uplink. In Release 18, eRedCap takes this further, targeting applications with even more modest data rate requirements by capping the peak data rate to 10 Mbps in both downlink and uplink, contributing to further reduce the device cost compared to RedCap.

In addition, Release 17 introduces some features for lowering the device power consumption that can be implemented by RedCap devices, eRedCap devices, and other 5G NR devices. The introduction in Release 13 of extended discontinuous reception (eDRX) cycles for battery endurance stretching into years for industrial sensors and wearables is further improved in Release 18 to provide even better battery life by enabling even longer cycles.

Crucially, RedCap is based on the 5G Standalone (SA) architecture, unlocking features such as network slicing, URLLC, API-based network services and cloud-native orchestration. This provides mobile network operators with the flexibility to serve a broader spectrum of IoT use cases without relying on legacy LTE infrastructure.

Early RedCap ecosystem momentum

As of April 2025, GSA has identified 30 operators across 21 countries investing in RedCap, including commercial launches by China Mobile, China Telecom, China Unicom, Dito (Philippines), STC (Kuwait) and T-Mobile US. Commercial tests and pilot deployments are underway globally, spanning the Americas, Europe, the Middle East and Asia-Pacific.

This early operator deployment momentum is being mirrored in the device ecosystem where leading chipset vendors such as Qualcomm, MediaTek, ASR and Sequans are providing RedCap-ready platforms. Module makers including Fibocom, Quectel, Telit Cinterion, Smawave and MeiG Smart have introduced RedCap-enabled products targeting gateways, wearables and CPEs. GCF-certified RedCap modules and devices are now emerging, with further growth expected throughout 2025 and 2026.

RedCap’s relevance spans both IoT and Fixed Wireless Access (FWA) domains and both consumer and industrial products. In IoT, RedCap enables scalable deployments across verticals such as industrial automation, smart energy and logistics, in retail with Point of Sales devices, and through consumer wearables such as smart watches and connected health devices. For instance, wireless industrial sensors can now benefit from enhanced uplink performance and energy efficiency, while wearables can offer voice over NR (VoNR) support without sacrificing form factor or battery life. Smart grid applications, such as substation telemetry and distribution automation, stand to benefit from RedCap’s latency and throughput profile, particularly in uplink-dominant traffic scenarios.

In parallel, RedCap is emerging as a viable alternative for FWA in markets transitioning away from LTE. GSA data shows that, as of late 2024, 494 operators in 176 countries had launched LTE or 5G FWA services. With 5G SA networks expanding and spectrum refarming on the agenda, RedCap-capable FWA CPEs present a compelling opportunity to deliver broadband to underserved regions, while freeing up LTE assets and simplifying operators’ RAN portfolios.

RedCap future

However, while RedCap is an abbreviation of Reduced Capability, the name can be misleading. New RedCap-based AI-enhanced devices are now being brought to market by vendors, combining local compute with smart networking. Supporting intelligent features such as adaptive roaming and power optimization modes using embedded AI models, RedCap devices can extend beyond connectivity to become an intelligent platform for service delivery.

Nevertheless, deployment is not without challenges. RedCap requires a functioning 5G SA core and while momentum is building, with GSA data reporting 154 operators investing in SA as of Q1 2025, coverage remains uneven. Roaming support is similarly nascent, requiring dedicated inter-PLMN agreements and the introduction of RedCap RAT types in core policy frameworks. Furthermore, network policies must be carefully managed to prevent low-complexity RedCap devices from adversely affecting cell-level resource efficiency, particularly in high-density scenarios.

For mobile ecosystem vendors, encompassing chipset suppliers, module manufacturers, device OEMs and infrastructure providers, RedCap represents both a commercial opportunity and a strategic lever for the deployment of new 5G use cases. By enabling cost-effective, future-proof connectivity across a diverse device landscape, RedCap supports the industry’s transition to scalable 5G SA infrastructure, while preparing the ground for future 6G use cases.

As RedCap matures, it will place a central role in the mid-tier device segment, replacing LTE Cat-3 / Cat-4 in IoT, and supporting mass-market 5G FWA deployments in parallel. Looking forward to the replacement of LTE Cat-1/Cat-1bis, eRedCap will further extend this value proposition into constrained device categories starting in 2026 and beyond.

This article previously appeared in 3GPP Highlights Issue 10 (June 2025)